INVENTORY TURNOVER FORMULA DAYS HOW TO

Ideally, you’d look to benchmark your turnover against similar businesses in your industry, but if this proves challenging, look at your trends and how to improve them. Usually, businesses with low gross margins need to turn their inventory more often, so they can offset their low per-unit profit with higher sales volumes. For example, an ideal stock turnover ratio for a fast-moving consumer goods retailer will be much higher than for a company that sells high-end furniture.

When analysing your stock turnover ratio, remember it will be relative to the stock you sell and your industry.

At the end of this period, the stock was valued at £163,000.The cost of goods sold over this period was £815,000.

INVENTORY TURNOVER FORMULA DAYS WINDOWS

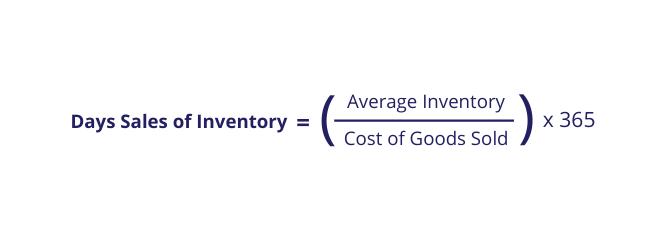

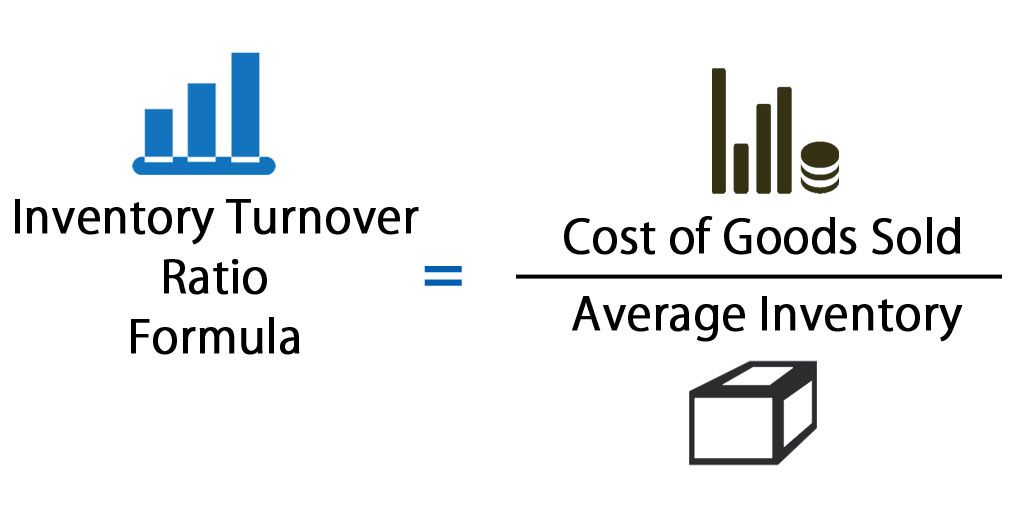

The ABC Doors and Windows Company wanted to calculate its inventory turnover for the last 12 months. Let’s look at an example for a company in the building materials industry. To calculate the average inventory value, add your opening inventory value to your closing inventory value and divide it by 2. To calculate the inventory turnover ratio, take the total cost of goods sold (COGS) over a specific period and divide it by the average inventory value during the same period. How do I calculate inventory turnover ratio? The inventory turnover ratio the ratio of the cost of goods sold to the average stock held. It is often used to measure the efficiency of warehouse or stock control processes to meet demand. You can use the formula to calculate how many days it will take to sell the inventory you hold. Inventory turnover ratio (also known as stock turn) is an accounting and inventory management KPI used to measure how often stock is sold (used or replaced) within a fixed period, relative to its costs of goods sold (COGS). However, inventory turnover is likely to fluctuate depending on changes in demand, supply chain disruption and other market factors. Higher inventory turnovers can highlight strong sales and good inventory stocking policies. Low inventory turnovers can indicate poor sales or excess inventory. It can help improve decision-making regarding pricing, manufacturing, marketing and purchasing. Inventory turnover (also known as stock turnover) measures how well a business manages its inventory to meet demand. You can track this using inventory turnover – the time it takes from bringing an item into stock to selling it. Most of your stock will be somewhere in the middle. Some will fly out of the door as soon as you get stock, while others that are slow-moving will sit on the shelves until you have to give them away or write them off. Different products sell at different rates.

0 kommentar(er)

0 kommentar(er)